Digital Distribution & GameStop [updated 12/19/08]

After iTunes killed Tower Records, I’m wondering what the effect of digital distribution for games will be on brick & mortar game retailers. In particular, I’m curious to see whether GameStop will end up with a fat lip, because I’m skeptical as to what extent the games industry is impervious to the current economic downturn.

A few weeks ago a few telecom giants worried that given these circumstances, people are likely to cancel their landlines, for example. In other words, people will be looking to get rid off those expenses that are, well, unnecessary. And so in deciding between a landline and cell phone, the latter likely wins. Similarly, I expect people to stop buying those $50 games.

This does not mean, of course, that people will stop playing games. That’s nonsense. What I think it means is that people will first and foremost look for ways to spend less on video games. And I see two ways to do this.

Digital distribution. An increasing amount of games is sold directly to consumers via the Internet. Most MMOGs are nowadays available for online download, using services like FilePlanet or Direct2Drive. Despite Lich King’s record sales of 2.4 million units within 24 hours, I’m not entirely sure that this is all through retail. According to EDGE, “Blizzard said it drew the sales figures from internal company records and key distribution partners.” In comparison, Burning Crusade sold the same number the first day, but wasn’t available for digital download until two weeks later. Blizzard quickly realized that shipping boxes takes longer, and makes less money, than putting it up online. Also, Romania, which counted 10,000 WoW players at the launch of Burning Crusade, only received 1,600 copies.

Along the same lines, casual game portals, like PlayFirst and BigFishGames, are becoming increasingly popular. Downloading a simple, relaxing game, has proved to be very effective and successful. PopCap, with its awe-inspiring Bejeweled success, generates 20% of sales in mobile space. (Did someone says iPhoneBerry?)

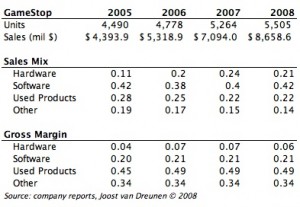

Second hand retail. You know that being broke ain’t fun. But you stil want to play your game. But unlike second-hand shoes and half-eaten sandwiches, a game is a game. It’s no surprise, then, that GameStop’s been pulling in a significant amount of doe, or 22% of annual sales. For GameStop this translated into about $1.5 billion in 2007. Of course, the rest of the game industry is screaming bloody murder because they don’t see any of that money. But that’s because they haven’t fully adopted digital download yet.

Meanwhile GameStop is expanding its territory. It already dominates Canada with about 75% of the second hand retail. Although Best Buy is trying to squeeze into this space as well, their US test a few years ago was unsuccessful. Besides, they can’t match GameStop’s inventory, don’t offer a cash option, and in-store credit can only go toward software and not hardware.

Moreover in early October GameStop announced its acquisition of Micromania for $700 million. Investors everywhere are exited, because the company has a lot of cash on hand (contrary to everyone else right now). And this immediately boosts GameStop’s European presence. Micromania adds another 332 stores, giving GameStop a leading market share of about 20% in one of the largest European economies. France’s video game retailing market, in fact, is growing: Micromania added about 40 stores annually over the past three years.

So?

Right now, GME’s stock is down. Way down. After acquiring EBgames a few years ago, its stock flew to high $60s, but is now back to less than $20. Someone seems to think that things are looking bleak. This was mostly after a few somber reports in September that the games industry was performed below expectations. But today GameStop announced its sales are up for this quarter ($1.7b) compares to last year’s ($1.6b).

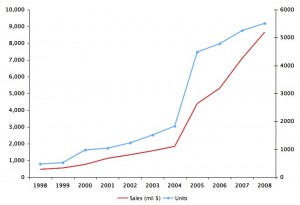

["Units" is investor speak for "stores," and on the secondary axis. Sales Mix is in percentages.]

The big jump in 2004 comes from GME’s acquisition of EBgames. If we apply some amateur math, we’ll see that, on average, a single GameStop store generates about 1.5 million in sales. Before the acquisition (2003 and 2004) this was 1.0m, followed by an all-time low of .97 in 2005, but a happy increase in recent years. Clearly, economies of scale are working out well.

Which brings me to the question: what is it that retailers, like GameStop, can offer that digital distribution cannot? In an economic downturn retailers can offer those precious second hand games that digital download does not. Using economies of scale, a solid inventory and loyalty program specialized stores like GameStop can continue to do very well.

[UPDATE, 11/21/08] A day after announcing its third quarter results, GameStop explains how it is dealing with the downturn. According to the brand new CEO Dan DeMatteo, the company has frozen its office hiring, will curb its store-opening habit, and will be ordering smaller amounts of merchandise to avoid overstocking. Especially this last one will ripple to game developers, when their new titles don’t do well in the first weeks. GameStop will simply not reorder. All the more reason for developers to take their show online, I’d say.

But five years from now, when all this economic drama has blown over, I believe that retailers are vulnerable to the cheaper, more convenient way of simply downloading games. Whether MMOG or just casual, games will be distributed digitally. And retailers will have to think of a way to really offer a service, like second hand, to stay in business.

[UPDATE, 12/06/08] Apparently back in September GameStop’s CEO Matteo argued that digital download will remain modest. For one, he argues, it opens the door to piracy, drawing a parallel with Napster. “The first digital distribution was Napster and it was illegal. Let’s just start there.” Then he makes the argument that even on a big fancy broadband pipe downloading a game would still take a very long time. “Right now, a 30GB game with your best T1 line is about 72 hours to do it.” And finally, the $20 price point of a digitally downloadable game is much lower than the $39 price point for a game sold through retail. In other words, if you sell your games online, you’ll make less money.

Obviously, I have some reservations with this. To start off and frame the issue in terms of piracy is a very conservative argument, and clearly looks at innovation as a threat rather than an opportunity. The same goes for the limitations on bandwidth: ultrabroadband is coming. Besides, the average download size of top MMOGs, which have most to gain from digital download, is about 3.2Gb; not 30Gb. But I’m skeptical of the suggestion that online distribution will make people less money. It’s essentially argument for artificial scarcity in that content producers limit distribution. But the value of things like games, especially multiplayer games, lies in many people playing it (e.g. network effects). And only selling where there’s a GameStop greatly limits your market potential.

Anyway, Bo Andersen, President and CEO of the Entertainment Merchants Association (EMA), more recently made similar noises: “Digital distribution certainly will be a significant part of the entertainment industry in the future, but our predictions are that packaged media will continue to dominate the home video sector until 2015 at least.” (Source) Another six years? Man, six years ago no one had ever even heard of broadband. Sounds like those retailers and packaged good people are trying to stifle innovation, rather than thinking of ways to profit from it.

[UPDATE 12/7/08] The larger context of online shopping, according to Shelly Palmer, CyberMonday saw a year-over-year increase from $733 million in 2007 to $846 million this year, or an approximate increase of 15 percent. With broadband penetration in the U.S. growing and currently at 57%, Palmer argues that universal access to WiFi will drive growth of online sales. He points out how traditional retailers, even those that are having difficult in meat space, saw a tremendous increase in traffic. “Even Sears, who can barely keep their doors open, is enjoying traffic success on the web,” says Palmer and concludes, “big companies and big brands are best positioned to take advantage of emerging technology.” It makes you wonder why GameStop isn’t spending more money on building their online presence.

[UPDATE 12/19/08] I keep finding bits of information on this topic, so I’ll add them for posteriority’s sake. According to an incomprehensible snippet on a study by Magid Advisors,”only six percent have bought a console game online and downloaded it online.” This observation comes from a panel of 674 people, who might be “confused with PC and casual game downloads” leading the actual number to be lower. Sounds like Magid’s questionnaire is using awkward phrasing. Moreover, it doesn’t offer any trended information, rendering it impossible to say whether this 6% is up, down or the same compared to last year, or whatever. Basically the conclusions are unfounded because it fails to explain ‘why’ (“It’s safe to assume…”), but I’m sure the GameStop people are thrilled. One forgiving element is it’s consistency (22%) with Interpret’s earlier observation that about 19% of people buy used games.